Mastering Diamond Investments for Future Gains

By Gary A.

Edited by Olivia H.

Published Mar 17, 2022

Edited on Dec 18, 2024

When it comes to diamonds investments, understanding how to maximize both sentimental and financial value is key to making a smart purchase that lasts a lifetime.

- Diamonds Investments: 8 Quick Tips for When Buying Diamond Engagement Rings

- Introduction

- Understanding Diamond Resale Value

- Why Investing in Diamonds Isn’t Like Investing in Gold

- Diamonds as Concentrated Wealth

- Why Natural Diamonds Retain Value More than Lab Grown Diamonds

- Making a Smart Investment

- Sentimental Value vs Financial Value

- Navigating the Diamond Market: Smart Purchasing Strategies

- Our Expert Take

- 10 FAQs

Diamonds Investments: 8 Quick Tips for When Buying Diamond Engagement Rings

Investing in a diamond engagement ring is not only a symbol of love but also a significant financial decision. When considering diamonds as an investment, it’s crucial to be well-informed about the various aspects that determine their value and potential return. Here are the most important practical tips to be aware of:

- Tip 1: Understanding the 4Cs Carat Weight: Larger diamonds are rarer and, therefore, more valuable. However, the price increases exponentially with size, so consider the carat weight in relation to your investment goals.

- Tip 2: Clarity: Look for diamonds with fewer inclusions. Higher clarity grades often result in better investment potential, but remember that some inclusions are not visible to the naked eye.

- Tip 3: Color: Diamonds come in various colors. Colorless diamonds (graded D-F) are traditionally prized for investment. However, certain colored diamonds, like pinks or blues, can offer excellent investment value due to their rarity. Cut: A well-cut diamond will have better brilliance and fire. The cut doesn’t just refer to the shape but also how effectively the diamond has been shaped and faceted. A better cut can significantly enhance the diamond’s appearance and value.

- Tip 4: Evaluating Market Trends and Demand: Understanding current market trends is crucial. While classic shapes like round and princess cuts are always in demand, certain diamond types, such as Argyle pink diamonds, have seen a rise in value due to their rarity and the closure of the Argyle mine.

- Tip 5: Analyzing Resale Value and Liquidity: Consider the potential resale value and liquidity of the diamond. Remember that certain types of diamonds and specific cuts might have a better resale market. Diamonds with a high degree of liquidity can be easier to sell if needed.

- Tip 6: Examining Certification and Grading: Always invest in a diamond that comes with a certificate from a reputable grading entity like GIA or AGS. These certifications provide an unbiased assessment of the diamond’s quality and are crucial for verifying its investment value.

- Tip 7: Assessing Rarity and Unique Attributes: The rarity of a diamond can significantly impact its investment potential. Unique attributes such as unusual cuts, historical significance, or diamonds with exceptional characteristics can enhance their value and desirability as investment pieces.

- Tip 8: Balancing Investment and Personal Preferences: While investment potential is important, balancing it with personal preferences for an engagement ring is crucial. Sometimes, the emotional value and the joy it brings can outweigh pure investment considerations.

Now that you’ve got these practical tips, use Jeweler AI below to find the perfect engagement ring that suits your style and budget:

Introduction

For most of us, making a quote-unquote ‘big spend’ naturally entails thinking ahead – way off, into some hypothetical future, when we may want to reap the rewards of our initial investment. Houses, cars, and even fine jewelry are all responsible for bringing about that money-mindedness, and beg the question, ‘How much of an investment into your future are you making?’

Diamonds are a big ticket item. In fact, they are probably one of the biggest ticket items most of us will ever bring home with us. But just how good of an ‘investment’ are they really? The answer depends on what sort of reward you’re looking to reap.

There are, however, a few things that any first-time ‘investor’ needs to be aware of. Diamonds aren’t the big, money-spinning venture they may seem like to an outsider – at least, not unless you’re making some wise moves at the big auctions.

Before we dive deeper into the specifics, here are some practical tips to help guide your decision-making process:

Understanding Diamond Resale Value

There are many factors, such as diamond value, and its value on the secondhand market. Here’s what you need to know.

The Long-Term Worth of Natural Diamonds

Natural diamonds are mined from kimberlite mines and alluvial deposits in a relatively short list of countries and regions around the world. Learning how diamonds are formed means really opening your eyes to the fact that these precious stones are limited and, one day, will have been depleted entirely.

Every natural diamond was formed over more than a billion years and had to cover incredible distances just to be close enough to the surface for miners to reach them.

Sure, diamonds themselves aren’t exactly rare. It’s not like buyers have to search hard just to come across a diamond for sale. But, even still, they are not a resource that can be replaced. As natural reserves go down over the years and decades, it is almost inevitable that value will increase. This is, of course, a process that will be spread out over the long term, but it is certainly on the cards for the industry.

Over the years, a number of notable mines have closed. Geologists and mining companies like De Beers continue to ‘break new ground’ (literally, and figuratively) when it comes to unearthing natural deposits. Canada only became a target for commercial diamond mining as recently as the 1990s and the diamond industries of countries like Sierra Leone are still considered to be heavily underutilized – although, of course, things are gradually changing.

Rarity and Quality: Why Some Diamonds are Considered Rarer than Others

Don’t be fooled into thinking that, because diamond is a finite, unrenewable resource, finding a stone to put in your engagement ring is going to have you trawling jewelry stores just to catch a glimpse of a single diamond for sale.

If that were the case, then the secondhand diamond market would be thriving. As of right now, however (and as we’ll look at in more detail below), the opposite is true, and the overwhelming majority of shoppers will target jewelry stores and other vendors selling new diamonds, rather than old diamonds.

Why Diamond Value Varies So Much

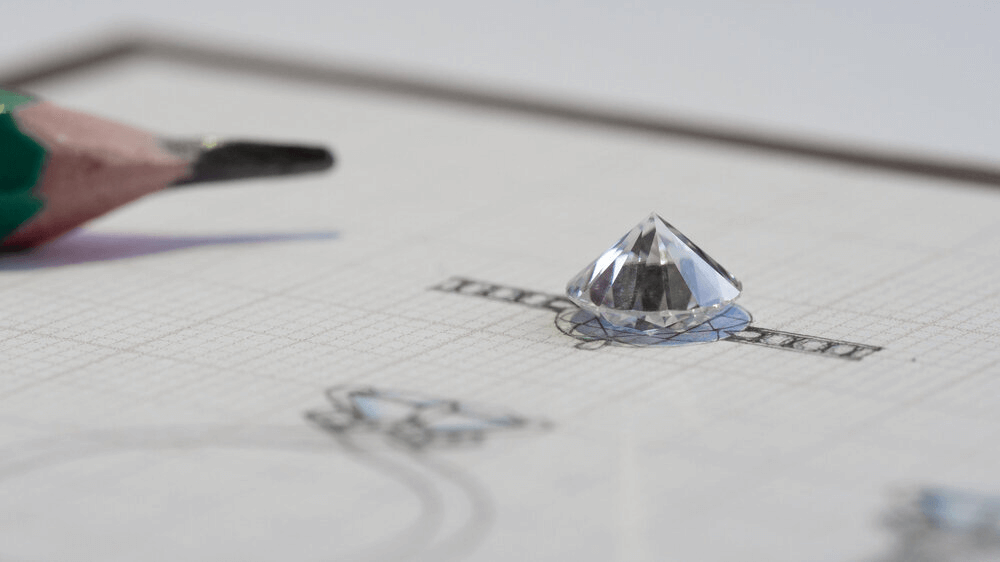

Natural diamonds are, by definition, created solely by the forces of nature. While, from a distance, a handful of diamonds cut to the same size and shape may all appear identical, beneath the surface lie many, many unique characteristics that make it easily identifiable to a gemologist or jeweler with the right tools to hand.

Sure, they are cut and polished by human beings, but these processes also leave their own distinctive mark. They might be totally invisible to the naked eye, but that doesn’t erase the fact that they are there, and a part of the diamond’s unique appearance.

This is why there is no ‘set’ or predetermined value for diamonds of different carat weights. The price range for 1 carat diamonds alone can stretch from $2,500 to $20,000, simply because of the fact that there are many, many, many different factors used to determine a diamond’s value.

Selecting Diamonds for Investments

You’re pretty unlikely to find any strong investment potential in the kinds of diamonds most commonly used in engagement rings. We’re talking about diamonds of the usual carat weights, or the typical ranges for clarity and color. For instance, this is where the most profound difference between FL and eye clean diamonds is found. An FL diamond will catch a lot of interest from collectors, whereas an eye clean VS diamond is one of a much larger collection of stones that are readily available around the world.

The sorts of diamonds worth investing in are diamonds that most of us can’t even consider investing in. For instance, just recently, records were broken by Sotheby’s Cullinan Diamond, a rare fancy vivid blue Emerald cut weighing 15.5 carats and featuring a clarity grade of IF. The stone sold at auction for $48 million.

Stories like these aren’t unfamiliar to us, but they are relatively rare occurrences compared with the sheer number of diamonds mined, cut, bought and sold around the world each year. Fancy colored stones – particularly those of red and pink – and Flawless or Internally Flawless diamonds with particularly high carat weights are the ones that make headlines for their auction value. This is a far cry from the diamonds most of us are considering.

Why Investing in Diamonds Isn’t Like Investing in Gold

Gold is a commodity with a universally held value. And, while that value is in a continuous state of flux, it means that, theoretically, an ounce of gold will always cost you the exact same amount as it would anywhere else in the world.

Diamond is very different. While the Rappaport Diamond Report is updated once a week, and advises a ‘price per carat’ for diamonds, that price changes alongside carat weight. In other words, the price per carat of 1.5 carat diamonds is different to the price per carat of 2, 3, or 5 carat diamonds.

What’s more, the price per carat is totally dependent on the color and clarity of the diamond, too. This is why you could hypothetically look at two 1 carat Round Brilliant diamonds side-by-side, one with a value of just over $2,000 and the other with a value of more than $20,000. If one features exemplary quality, and the other features severe inclusions and a poor color, their prices per carat will be totally different.

This is a far cry from a commodity like gold, which simply has a value per ounce that is recognized around the globe. It’s also why making a strong choice over which diamond to purchase for your engagement ring takes time and effort, rather than being a process of choosing a carat weight that fits your budget.

You can read more about diamond prices in this guide.

Why Diamond Value Dips After Purchase

Again, this isn’t something that is unique to the diamond world. Plenty of investments lose value the moment they become ‘second hand’ and, unless you make use of any 30-day money-back guarantees from the original seller, you will find it tricky to break even through the resale market. For classic cars, this starts to change after a few decades but, for diamonds, how long it takes for that value to ‘replenish’ itself depends on the diamond, its backstory, and the amount of time that passes.

Ownership is a major factor behind resale value. Elizabeth Taylor’s 33.19 carat Asscher cut ‘Krupp’ diamond, for instance, was last sold at auction for more than $8.8 million. While a lot of that value stems from the quality and size of the diamond, it’s fair to say that its history as a symbol of one of Hollywood’s most elite couples would have also represented a major contributing factor.

Jewelry owned by some of the world’s most notable style icons accumulate value at a tremendous rate. Their prominence in paparazzi shots or movie promotions makes them an irresistible prospect for the world’s most prolific collectors, and not simply because celebrities can afford the highest quality diamonds.

It echoes the same enduring sentimentality we feel toward natural diamonds, and not toward lab grown diamonds. Collectors and first-time buyers alike are drawn to history and meaning, rather than appearance alone.

What this does mean, however, is that your diamond is very unlikely to gather value in the same way as a comparable diamond worn by one of the world’s big names.

Diamonds as Concentrated Wealth

A 1 carat diamond is the equivalent of 0.2 grams but, as we mentioned, a particularly high quality stone of that weight could have a value of around $20,000. This is an incredibly concentrated form of wealth, making it an attractive opportunity for someone who wants to diversify their investment portfolio, without losing that opportunity for easy liquidation.

Why Natural Diamonds Retain Value More than Lab Grown Diamonds

Remember how we said that natural diamonds are a finite, exhaustible resource? The opposite holds true for lab grown diamonds. We’ve written in the past about how the fact that lab grown diamonds are a sustainable alternative – a phrase which, here, simply means we can continue to make more and more of them indefinitely.

At WillYou, we recognise the value lab grown diamonds hold as an affordable alternative to natural diamonds. After all, lab grown diamonds are infamously cheaper since they don’t require the same effort to mine them from the earth.

The trouble is that they do not retain value anywhere near the same way as natural diamonds. For starters, lab grown diamonds are a relatively new phenomenon; we can’t predict how they’ll be received by collectors and investors in the future.

What we can know, however, is that they will never be rare. They are the end product of an efficient production chain, rather than a natural force that took more than a billion years to bear fruit.

Making a Smart Investment

While the small, everyday purchases we make tend to be ideal for finding good deals, drumming down the price, and minimizing our financial outlay without sacrificing on quality, diamonds are a different ballgame entirely. When there is so much at stake, taking the shortcuts laid out for newcomers is a big risk and something that we frequently urge our readers against.

Some of the most obvious ‘shortcuts’ that promise to save customers money are from unreliable online vendors. Sure, some are diamond scams, but many of them aren’t – they’re just not ideal for anyone looking to spend their money wisely.

When they choose to go online, shoppers can save money on a diamond, but saving money means relinquishing the opportunity to really appraise that diamond before passing over a large, lump sum. This is why it’s essential to only shop at online stores with dependable and proven industry experience. For instance, buying diamonds and rings from our online store means that a collective 175 (and more) years of experience has gone into what you’re buying. Our diamond experts hand-checking the diamonds have 45 years; our partner, jewlery makers A.Jaffe have over 130 years. This is knowledge and skill you can trust.

As we mentioned above, diamonds are totally unique objects. There’s a lot to consider before you can be sure about your investment.

Sentimental Value vs Financial Value

Plenty of first-time diamond buyers, when preparing to make that big spend on their ring, can’t help but consider the bigger financial picture. When we spend $10,000 on anything, it’s guaranteed our mind will run off into some distant, hypothetical future and consider what sort of return we could get on it.

What’s important to keep in mind, however, is the fact that, unless you’re a dedicated investor of fine pieces – or an avid collector – it’s pretty unlikely you will want to cash in that potential value in the future.

Why? Because, for the average buyer, a diamond is purchased as a symbol of love and commitment, and there’s a strong chance that the sentimental value of that diamond will ever go away entirely. Sure, you may reach a point in the future when you want to ‘trade up’, but there are ways of doing that without having to deal with the complexities of the secondhand diamond market…

Diamond upgrades are often the better option, and readily available

These days, a lot of jewelers offer their own diamond upgrade schemes. Through these, past customers (and, on occasion, new customers, although this isn’t quite so common) can return to the store and exchange their old diamond for a new one, only paying the difference in value between them. This is a great alternative to selling your diamond yourself since you’re effectively getting the original purchase price – although, obviously, the one downside is you won’t actually wind up with any extra cash in your pocket.

For this reason, it’ll be pretty obvious to you that a diamond upgrade isn’t the right choice if you’re simply looking to realize some sort of return on your original investment. But, if you’re in the market for a new piece of jewelry anyway, it’s an ideal alternative. Selling the diamond yourself in order to generate funds for a new piece won’t prove anywhere near as effective.

We’ve written a much more comprehensive guide to diamond upgrades already at WillYou.com, and it’s certainly worth a read – even if you’re not convinced you’ll ever want to swap out your original diamond for something new.

Navigating the Diamond Market: Smart Purchasing Strategies

Depending on the vendor in question, prices are not always reflective of good quality. Affordable, pre-set rings featuring a vague clarity grade (phrases like ‘at least I1 clarity’, which promises very little), may seem like a good idea to someone with no prior knowledge in this area, but, in reality, they are a terrible waste of money.

Spending your money wisely means knowing how to avoid overpaying – something that, for various reasons, is all too easily done in the diamond world.

Know how not to overpay

For starters, you could overpay for a diamond that is not worth anywhere close to the price listed. This isn’t the same as paying for the margin bricks-and-mortars apply to their own diamonds – which, as we mentioned, is worth paying just for the added benefit of working alongside an expert – but happens when sellers attach a high premium to their products as a result of their name and reputation.

We found this to be the case at a lot of high-end jewelers. While we mentioned above that the luxury jewelry brands tend to fare better on the resale market, it’s still the case that, at the point of purchase, customers are overspending on their diamonds by thousands and thousands of dollars. If you’ve no guarantee you’ll want to sell in the future, this seems like a missed opportunity to find something a lot better for a lot less money elsewhere.

High prices aren’t just limited to the high-end. As we mentioned, we’ve encountered a number of chains selling low quality or uncertified diamonds at prices that don’t always reflect the quality of the product.

It’s very important that any shopper is aware of the fact that they will always overpay if the diamond they purchase is not accompanied by a GIA or AGS report, or of a high enough quality that it appears eye clean, bright, and free from color.

Know what makes a good diamond

A poorly cut diamond is never a good investment. These diamonds are not seen as attractive prospects in the resale market. While it is possible for someone to get a diamond recut, doing so means sacrificing a significant amount of carat weight – something that, as you can imagine, quickly starts to knock zeros off a diamond’s value.

The same goes for proportion and ratio. Don’t waste your money on a diamond with less-than-ideal proportions, even if the price looks good.

Diamonds with noticeable inclusions will also perform worse on the secondhand market – just as they perform worse in the jewelry stores. The same goes for diamonds with poor color, so stick within the Colorless – Near Colorless range.

Fluorescence is a complicated subject – and, in some ways, open to interpretation and personal preference – but it’s important that any buyer understands it before they spend their money.

Keep in mind, too, that some diamond shapes are more vulnerable to damage than others. Shapes with sharp corners, like the Princess, or fine points, like the Marquise, Pear, and Heart, can take on damage a lot easier than shapes like the Oval or Round Brilliant. There are ways of ensuring the more vulnerable parts of the cut are protected during wear, but, if you’re focused on the longevity of your diamond, it’s worth being aware of the risks.

Consult the experts

Every shopper is different. Their budget, style, priorities and concerns for the future are all unique to them, so there is only so much a single guide – no matter how comprehensive it is – can do for you, or for anyone else.

This brings us back to the importance of having an experienced and reliable jeweler by your side throughout the entire process of finding and buying a diamond. There is so much groundwork to cover if you’re truly interested in maximizing every cent of your budget and avoiding any of the pitfalls laid out for first-time shoppers who don’t know the first thing about diamonds, or their value.

Jewelers are there for more than just handing over your ring at the end of the process. Many of them have worked in the industry for decades, or inherited knowledge through generations, and they know how to get the best for their customers.

Our Expert Take

Diamonds are incredibly valuable items, but using them as an opportunity for a long-term financial investment means that you’ll want to understand the market inside and out, and invest in a diamond that will be sure to continue generating interest among collectors and other potential buyers long into the future.

It’s a complex subject and, for the average buyer looking to invest in an engagement ring, needn’t be a top concern. Nevertheless, it’s another compelling argument in favor of working with a reputable professional and ensuring that you know how to find a truly worthwhile diamond, rather than a waste of money.

10 FAQs

- Q: Are Diamonds a Good Investment?

- A: Diamonds can be a good investment if chosen wisely. High-quality, rare diamonds like colorless or unique colored diamonds tend to hold or increase their value over time.

- Q: What Makes a Diamond a Good Investment?

- A: Rarity, quality (based on the 4Cs), market demand, and uniqueness make a diamond a good investment. Certificates from reputable grading agencies also add to their investment value.

- Q: Do Diamonds Appreciate in Value Over Time?

- A: Some diamonds, especially rare and high-quality ones, can appreciate over time. However, market trends and demand play a significant role in determining their value appreciation.

- Q: How Does the Resale Value of Diamonds Compare to Their Purchase Price?

- A: The resale value of diamonds generally ranges from 20% to 35% of the purchase price for natural diamonds. Lab-grown diamonds typically have much lower resale values, often less than 1% of the purchase price.

- Q: Are Lab-Grown Diamonds a Good Investment?

- A: Lab-grown diamonds are not considered a good investment compared to natural diamonds due to their significantly lower resale value and abundant supply.

- Q: What Diamond Characteristics Should I Focus on for Investment?

- A: Focus on the 4Cs (Carat, Clarity, Color, and Cut), rarity, certification, and market trends. Unique or historically significant diamonds can also be good investment choices.

- Q: Which Diamond is Best for Investment?

- A: The best diamonds for investment are usually those with high clarity, colorless or rare colors (like pink or blue), good cuts, and larger carat sizes. The rarity and certification also play a crucial role.

- Q: How Can I Ensure the Authenticity of a Diamond?

- A: Always buy diamonds with a certificate from a reputable grading institution like GIA or AGS. These certificates provide an unbiased assessment of the diamond’s quality.

- Q: Is Investing in Diamonds Better Than Gold?

- A: Diamonds and gold have different market dynamics. Diamonds are better for those looking for unique, tangible assets, while gold is a traditional hedge against market volatility. The choice depends on your investment goals and market understanding.

- Q: How Liquid is the Diamond Investment Market?

- Answer: The liquidity of diamond investments can vary. High-quality, certified diamonds with popular characteristics are generally more liquid. However, selling diamonds might take time compared to more liquid assets like gold or stocks.

Elevate your future engagement ring shopping with Jeweler AI‘s diamond investment wisdom.

FOLLOW-UP GUIDE SERIES