Engagement Ring Hacks: Financing Budget-Friendly Tips

By Gary A.

Edited by Olivia H.

Published Aug 8, 2024

Edited on Mar 31, 2025

Engagement ring financing can help you get the perfect ring without straining your budget—here’s how to make it work for you while ensuring smart and affordable choices.

Navigate This Guide:

- 10 Quick Tips for Financing Your Engagement Ring

- Introduction

- Understanding the Basics to Engagement Rings Financing

- Options for Financing Your Dream Ring

- Navigating Bad Credit Financing

- The Pros and Cons of Engagement Ring Financing

- Our Expert Take: Making the Right Choice

- 10 Frequently Asked Questions on Engagement Ring Financing

Before we dive deeper into the specifics, here are some practical tips to help guide your decision-making process:

10 Quick Tips for Financing Your Engagement Ring

- Tip 1. Budget First:

- Determine how much you can afford as an initial down payment and as a monthly installment. Don’t let enticing financing offers lure you into spending more than you can afford.

- Tip 2. Understand the Terms:

- Thoroughly read the financing agreement. Pay special attention to interest rates, late fees, and any penalties. Some offers might have low or 0% interest for a set period but could have high rates after that period.

- Tip 3. Shop Around:

- Compare financing options from different jewelers and financial institutions. Even a slight difference in interest rates can result in significant savings over time.

- Tip 4. Assess Your Credit:

- Before seeking financing, know your credit score. It will influence your interest rates and the financing options available to you.

- Tip 5. Avoid Maxing Out Credit:

- Using too much of your available credit, especially on credit cards, can negatively impact your credit score. Aim to use less than 30% of your credit limit.

- Tip 6. Stay On Top of Payments:

- Ensure you never miss a payment by setting up automatic payments. Late or missed payments can result in added fees, higher interest rates, and a hit to your credit score.

- Tip 7. Reconsider Ring Choice:

- If financing seems overly burdensome, consider choosing a less expensive ring initially. Remember, you can always upgrade later when your financial situation allows.

- Tip 8. Beware of Hidden Fees and Charges:

- Some financing deals might come with application fees, annual fees, or early payoff penalties. Always read the fine print and clarify all costs involved before finalizing the financing deal.

- Tip 9. Seek Pre-Approval:

- Before settling on a specific ring or jeweler, check if you can get pre-approved for financing. This gives you an idea of what you can afford and allows you to negotiate better terms or discounts, having a clearer picture of your budget.

- Tip 10. Understand the Resale Value:

- Financing an engagement ring is a significant commitment. It’s wise to have an understanding of the ring’s resale value should circumstances change or if you decide to upgrade in the future. Remember, while diamonds generally retain value, the setting or style might not.

Now that you’ve got these practical tips, use Jeweler AI below to find the perfect engagement ring that suits your style and budget:

Introduction

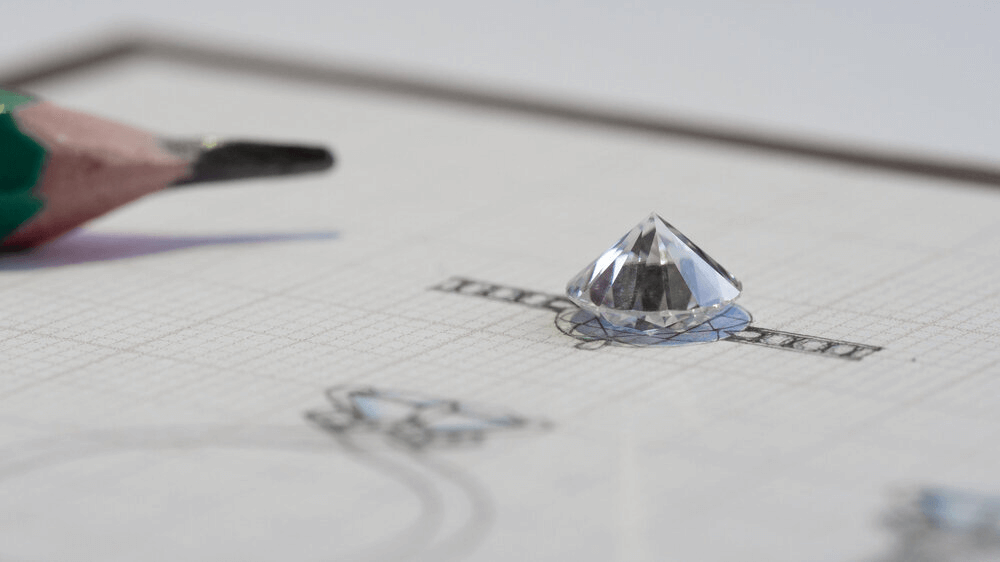

One of the most heart-wrenching things to happen while engagement ring shopping is finding the ring of your dreams – the perfect diamond, the perfect setting, the perfect style, perfect everything – and realising that it goes far beyond your budget.

Engagement rings are a symbol of love, after all. It’s not fair that the love between you and your partner cannot be celebrated with the perfect ring, whatever the price, and whatever else you choose will always feel like the ‘second option’. This, however, is why engagement ring financing is becoming such a popular option.

Understanding the Basics to Engagement Rings Financing

For those unaware, engagement ring financing refers to the process of borrowing money to purchase a ring, and then paying it off over time through instalments. This is typically done by applying for a loan or financing plan through a jewelry store, bank, credit union, or online lender.

The application process involves providing personal information such as your income, employment status, and credit history. If approved, details are then sent about the loan terms, including the interest rate, repayment period, and any fees or penalties that might be applied.

Why Consider Financing?

The reason for choosing this route is simple: engagement ring shopping is expensive, and sometimes lump sums can be too much. If you want to buy a ring of quality, with excellent 4 C grading and authentication, this could set you back anywhere from $25,000 to $100,000, or perhaps more, and many of us don’t have that kind of money to hand. Financing the engagement ring, then, is a way to pay for the ring gradually, removing the money from your bank account without emptying it, and doing so in a way that’s comfortable for the buyer.

Options for Financing Your Dream Ring

There’s no one type of financing method. If you’re looking for a dream ring and it’s going to cost you more than what you can afford, there are several options for you to look into. ut before diving into financing plans, you might find yourself wondering: how much to spend on an engagement ring?

While traditional guidelines suggest spending two to three months’ salary, the reality is that your budget should reflect your financial situation and priorities. Financing allows flexibility, but it’s important to determine an amount that feels right for you before committing to any specific plan.

We’re going to talk about three of the most common below, with a few notes on how you can go about attaining them.

Personal Loans

A personal loan can be obtained from a bank, credit union, an online lender, or a peer-to-peer lending platform. The application process in this case typically involves providing personal information – your income, employment status, and credit history – and the amount you wish to borrow.

Depending on your credit history and the lender’s policies, this can range from a few thousand dollars to tens of thousands, but each loan will include an interest rate, which means you’ll pay back more than the amount you borrowed over the loan’s term.

“Buy Now, Pay Later” Plans

Another common financing option is a BNPL plan – “Buy Now, Pay Later”. This involves making a purchase online or in-store and spreading your payment over a period of months – with an initial upfront cost that is a fraction of the overall ring value.

Unlike personal loans, many BNPL plans are interest-free, which means there will be no interest charges so long as the payments are made on time. The only potential issue is that some BNPL plans encourage overspending, especially if you’re not careful with your budget. With a bit of research, however, this can be avoided.

Jewelry Store Financing

If you’re looking for particular jewelry store financing, this typically involves filling out a credit application and providing the personal information we talked about earlier. Options here also include in-house financing, third-party financing, and promotional financing – where jewelry stores offer special promotions, such as zero-interest or deferred payment plans.

While the interest rates might be a little higher compared to other options, this is a great option if you’re looking for speed and convenience, as many stores will do the credit check on the spot.

Navigating Bad Credit Financing

We’ve mentioned the potential need for credit checks multiple times, but it should be noted that not everyone has a strong credit score. This is one of the issues with BNPL plans, for instance.

While these plans don’t often require a credit check, if you’re late or drag behind on your payments, some providers might still report you to credit bureaus, potentially impacting your overall consumer credit score. If you find that you have a bad credit score and cannot utilise your credit to pay for your dream ring, there are still a few options for you to consider.

How to Secure Financing with Bad Credit

One way to secure financing with bad credit is to opt for ‘no credit financing’ solutions, where lenders assess your ability to repay based on factors other than your credit score.

This could include payday loans – short-term loans intended to cover expenses until your next payday – installment loans – loans repaid over time with a fixed number of scheduled payments – or rent-to-own agreements, which allows you to rent with the option to purchase later – although this isn’t a common option in the jewelry industry. What will be checked in these instances include your income, employment status, and banking history, although there are other ways you can attain approval.

Best Strategy for Securing Loan Approval

One of the best ways to attain approval if you have a bad credit score is by asking someone to help you out. A trusted friend or family member, for instance, can co-sign a loan and take responsibility for the debt if you fail to pay it. As well as this, you can offer to make a larger down payment, saving up for a few months to increase the upfront payment and reduce the risk for the lender.

Improving your debt-to-income ratio should also be considered, and if you have the time, you should look into building your credit by keeping your credit card balance low, becoming an authorised user of someone else’s card, or taking out a smaller loan and making timely payments to demonstrate your creditworthiness.

The Pros and Cons of Engagement Ring Financing

These are the best strategies we know of to finance your dream ring, but before you start asking for loans, it’s important to compare each option, understand their interest rates and fees, and then make a decision that works for you.

There are, of course, pros and cons to engagement ring financing, and as we mentioned previously, there isn’t one option that works for everyone – even though this would make things so much easier! With this in mind, you should start by weighing the advantages and disadvantages, putting them in line with your financial situation.

Advantages of Financing

The biggest advantage of financing is that it gives you immediate access, without having to save up for the full amount over several months – or even years. The payment options are also flexible, with various repayment terms and possible fees, meaning you can find options that might be more catered to you as a consumer.

Additionally, if you do decide to finance an engagement ring and make continuous timely payments, this will similarly help to build your existing credit score and make it easier to qualify for any loans in the future – you’re going to need to buy a wedding ring too, after all!

Potential Drawbacks

But while this is all positive, financing does typically come with interest charges, which means the cost of the ring is going to increase over time. Failing to make timely payments can also result in late fees and penalties, which can damage your credit score and, once again, make you pay even more than you would have done if you’d bought outright. Depending on your creditworthiness, you may also be limited to certain financing options, such as the ones we mentioned earlier, with higher interest rates or less favourable terms.

Opting for financing also means you’re committing to a long-term financial obligation, which might not be so great for your particular financial situation. While buying an engagement ring outright might be steep, for instance, at least the process is over and the payment is done. With financing, however, you’ll be making continual payments, and your bank balance will slowly be going down, rather than abruptly – ever heard of the phrase: ‘Just pull the band-aid?’

Our Expert Take: Making the Right Choice

Not everyone can afford to pull the band-aid, though. We’re aware of that. And that’s why we’ve listed out some of the best ways to still buy an engagement ring, without making such a big, immediate sacrifice. The important thing is to look into every option and to make a sensible, informed decision.

Try not to be impatient, but similarly, don’t lose hope that your dream ring can never be yours. As we mentioned previously, everyone has the right to the perfect ring, and financing might be your best option for getting it into your hands – or rather, placing it where it belongs, onto your partner’s finger.

10 Frequently Asked Questions on Engagement Ring Financing

- Q: Can I finance an engagement ring with bad credit?

- A: Yes, there are financing options available even for those with bad credit. Some jewelers offer in-house financing plans or partner with lenders who specialize in bad credit financing. However, interest rates may be higher.

- Q: How does engagement ring financing work?

- A: Engagement ring financing allows you to spread the cost of the ring over a set period, making monthly payments. Options include in-store financing, personal loans, credit cards with promotional rates, or “buy now, pay later” plans.

- Q: What’s the best way to finance an engagement ring?

- A: The best financing option depends on your financial situation. For those with good credit, a 0% APR credit card or a low-interest personal loan could be best. For others, in-store financing or “buy now, pay later” plans might suit better.

- Q: Are there interest-free options for financing an engagement ring?

- A: Yes, some retailers offer promotional 0% interest financing for a set period. Credit cards with 0% introductory APRs on purchases can also be used for interest-free financing if the balance is paid off within the promotional period.

- Q: Do I need a down payment to finance an engagement ring?

- A: Some financing options may require a down payment, while others may not. It varies by retailer and the type of financing plan chosen.

- Q: Can I finance an engagement ring online?

- A: Yes, many online jewelers offer financing options, including “buy now, pay later” plans, personal loans through third-party lenders, or credit lines specifically for jewelry purchases.

- Q: How can financing an engagement ring affect my credit score?

- A: Applying for financing can result in a hard inquiry, which may temporarily lower your score. Making on-time payments can positively impact your score, while late or missed payments can harm it.

- Q: Is it possible to pay off my engagement ring financing early?

- A: Yes, many financing plans allow early payoff without penalties, but it’s essential to read the terms and conditions to ensure no early payoff fees are associated with your particular plan.

- Q: What should I look out for in the fine print of an engagement ring financing agreement?

- A: Look for details about interest rates (and when they apply), late fees, penalties for missed payments, and any hidden fees or charges that could increase the total cost.

- Q: Can I return an engagement ring I financed if I change my mind?

- A: Return policies vary by retailer. Some may allow returns or exchanges within a specific period, even for financed items, but restocking fees may apply. Always check the return policy before purchasing.

Explore with Jeweler AI: Perfectly finance your dream ring today!

FOLLOW-UP GUIDE SERIES