Engagement Ring Insurance: Tips for Lasting Protection

By Gary A.

Edited by Olivia H.

Published Jul 28, 2022

Edited on Dec 18, 2024

When protecting your investment, engagement ring insurance offers peace of mind, ensuring that no matter where life takes you, your cherished ring remains covered.

Navigate this guide:

- 7 Quick Tips for Buying and Insuring a Diamond Engagement Ring

- Introduction

- Decoding Insurance Coverage

- Comparative Analysis of Top Insurers

- Selecting the Right Insurance

- Our Expert Take

- 8 Frequently Asked Questions About Engagement Ring Insurance

Before we dive deeper into the specifics, here are some practical tips to help guide your decision-making process:

7 Quick Tips for Buying and Insuring a Diamond Engagement Ring

- Tip 1: When opting for engagement ring insurance, thoroughly examine what the policy includes. Check if it covers scenarios like theft, accidental loss, and damage. Pay special attention to any exclusions, such as specific circumstances or locations that may not be covered by the policy.

- Tip 2: The market value of diamonds can change over time. It’s advisable to have your engagement ring appraised every few years to ensure that your insurance coverage aligns with its current value. This step is essential to avoid being underinsured, which can lead to significant financial losses in the event of a claim.

- Tip 3: For those who travel often, selecting an insurance policy that offers worldwide coverage is crucial. This ensures that your engagement ring is protected against theft or loss, no matter where you are. Always verify if there are any geographical limitations or special conditions related to travel within the policy.

- Tip 4: Choose a policy that provides replacement value rather than just the cash value. Replacement value policies are designed to cover the cost of replacing your ring with an equivalent item at current market prices, which is typically higher than the ring’s original purchase price or its depreciated cash value.

- Tip 5: Research the insurer’s reputation, especially regarding their claims process. Read customer feedback and review their history of claim settlements. A reliable insurer should have a transparent, efficient claim process and a track record of fair and timely settlements.

- Tip 6: Gain a clear understanding of the insurer’s claims process. Familiarize yourself with the necessary documentation, how the ring’s value is assessed during a claim, and the expected timeline for claim resolution. Knowing these details in advance can streamline the process if you ever need to file a claim.

- Tip 7: Consider the deductible amount you are comfortable with. A higher deductible typically means a lower premium, but it also increases your out-of-pocket expenses in the event of a claim. Find a balance between the deductible and premium cost that suits your financial situation.

Now that you’ve got these practical tips, use Jeweler AI below to find the perfect engagement ring that suits your style and budget:

Introduction

First comes love, then comes a diamond, then comes browsing the internet for insurance because, oh dear, you’ve just realized quite how much money is sitting on the fourth finger of your fiancée’s hand while she shops, rides the subway, travels abroad, rifles through her overcrowded handbag, walks along the beach, through the woods, along the pier – or, really, anywhere where a diamond could vanish forever.

Sure, Kim K got teased by millions of internet users for crying over her lost diamond earrings (now somewhere at the bottom of the Tahitian Ocean), but the average engagement ring is a very different story. We can’t imagine the feeling of looking down to find your diamond has worked itself loose, or that the entire ring has just upped and disappeared – but looking down to find your finger empty and not having some kind of financial safeguard in place? Unthinkable.

Here is our comprehensive guide to everything you need to know, understand, and do when it comes to insuring your engagement ring. Purchasing a policy may not be anywhere near as exciting as purchasing the ring itself, but it’ll sting a lot less.

Decoding Insurance Coverage

At the end of the day, insurance is all about protecting your investment, whether you’re taking out insurance on an engagement ring, a house, a car, or any other expensive purchase. True, engagement ring insurance only covers 1 aspect of an engagement ring’s value. Unlike most cars, engagement rings can’t just be replaced with a like-for-like substitute without some emotional element coming into play. There’s a lot of sentiment bound up in that specific diamond, and that specific ring.

But a good insurance policy goes a long way – trust us. If the worst happens, you’ll be glad to have it.

Engagement ring insurance offers…

- Financial protection, since replacements or repairs will likely be covered – at least partially. If you think of how much your engagement ring cost you the first time around, imagine how much it will cost you the second time around. Most of us don’t budget for an extra.

- Peace of mind, since walking around with a very valuable and one-of-a-kind piece of jewelry on your finger every day and not worrying about it every second is a mental game.

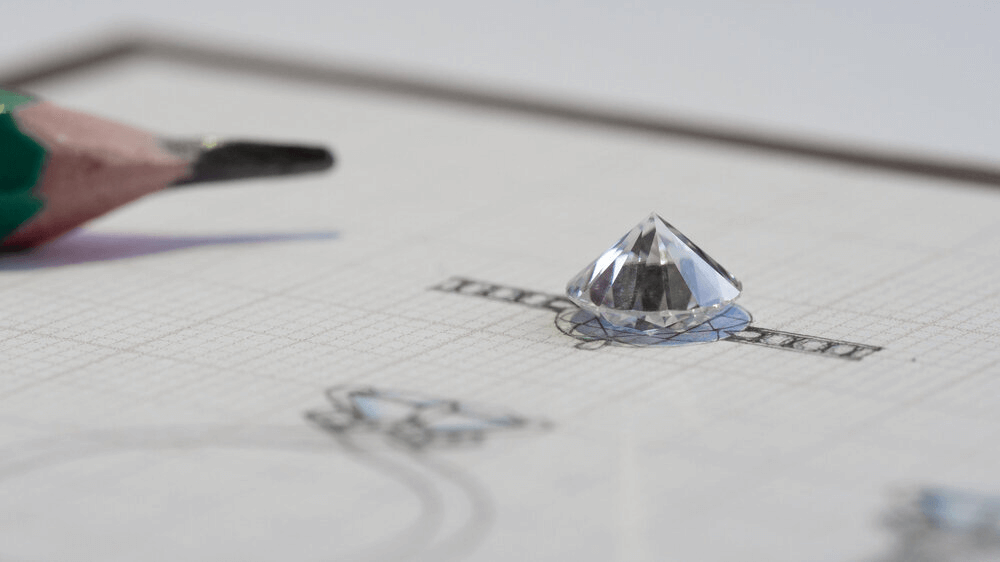

Getting engagement ring insurance is relatively simple, in theory. First, you need to get the ring appraised. It’s not about telling your insurer what you paid for the ring, but about telling them what its current value is. Remember, engagement rings do lose value the second they become quote-unquote ‘second-hand’.

Here’s something to keep in mind. There are policies out there that offer replacement value as opposed to cash value. In these instances, the insurer will look at paying out a sum that enables you to purchase a like-for-like replacement, and that can mean that you get more than you would if you took out a policy for cash value. With a cash value policy, you will likely need to supplement the insurance payout yourself in order to afford a like-for-like replacement. These policies are more expensive, but they’re a great option to keep in mind.

Next, you need to pick your insurer. This is something we can help with below. You can either add a rider to your existing policy or take out a standalone policy with an insurer that specializes in fine jewelry. Either way, you’ll want to make sure that the policy aligns with your budget, and the value of the ring, and that it covers key risk factors associated with your lifestyle. You don’t want to lose your ring, then find out the scenario in which it was last just isn’t covered by the policy.

When you’ve got your insurer, you want to compare their policies. There won’t be a one-size-fits-all option. It’s about working out what aligns with your lifestyle and what offers the best possible chance of protecting you.

Comparative Analysis of Top Insurers

So, the key question. With a head full of diamonds and gold, how are you supposed to figure out which insurer stands out from the rest… and for all the right reasons?

When it comes to diamonds, we’ve been around the block a few times. Here is a comparison of some of the biggest insurers out, and how they perform when it comes to ensuring engagement rings and other fine jewelry.

Jewelers Mutual: Comprehensive coverage with global reach

Jewelers Mutual is a trusted name in the world of jewelry insurance, known for its extensive coverage options and global reach. Founded in 1913, this insurer offers specialized policies that cater specifically to those with collections of fine jewelry, providing protection against a wide range of risks including theft, loss, damage, and mysterious disappearance.

One of the standout features of Jewelers Mutual is their comprehensive coverage, which offers a broad scope for policy holders, particularly if they travel.

Their policies often include provisions for preventive maintenance and repairs, which is great for anyone who wants to keep their engagement ring looking just as it did the day they said, ‘Yes’.

There’s also a high-end vibe to the service. You can expect top-tier customer service and a seamless claims process – although, hopefully, you never need to find out for yourself…

Lavalier: Customized policies for diverse needs

Lavalier Jewelry Insurance also offers tailored insurance solutions, and engagement ring owners will find plenty to like here. They really excel in their customizable policies, allowing you to choose coverage options that best match your lifestyle and the specific value of your jewelry – and the sort of financial help you’d be looking for in a worst-case scenario.

Lavalier is all about flexibility, so it’ll take a little time to find the right policy – but it’s 100% worth it.

As we mentioned earlier, taking out a policy on your ring means getting an appraisal – and Lavalier offer this service themselves, helping you figure out the value of your ring so that you receive appropriate compensation in case of a claim.

The application process is straightforward, and their customer service is first-rate. Always a plus.

Briteco: Balancing affordability with extensive coverage

Briteco stands out for affordability – although not at the cost of extensive coverage.

This is a high-tech, modern insurer with a streamlined process, from appraisals to payouts.

They also offer convenient digital tools that make it easy to manage your policy and file claims online. With Briteco, you get the advantage of extensive coverage options coupled with affordable premiums, ensuring your engagement ring is well-protected while keeping that wedding and honeymoon budget in check.

State Farm: Integrating with home insurance for broader options

State Farm probably the most familiar name on this list, offering a range of policies that can be integrated with your home insurance. That level of convenience can be a big selling point to a lot of people.

State Farm’s engagement ring insurance offers protection against common risks such as theft, loss, and damage – all the things you would expect. By adding a rider to your homeowners or renters insurance, you can (often) cover your engagement ring at a lower cost than a standalone policy.

State Farm is known for its reliable customer service and efficient claims process, making it a solid choice for those seeking to protect their valuable jewelry within a broader insurance framework.

Chubb’s Jewelry: Tailored for high-value pieces

Chubb’s Jewelry Insurance is designed with high-value pieces in mind, but they’re not sticks in the mud. Their policies are known for their flexibility and wide coverage, and they’re great for unique, high-value pieces without imposing strict limits within their policies.

For those with high-value engagement rings, Chubb is probably the go-to. You’ll get peace of mind and a level of service that really fits with the value of your ring.

GemShield: Customer-centric, all-risk coverage

GemShield is a great all-rounder. It takes a customer-centric, all-risk approach to coverage for engagement rings and other fine jewelry.

Their policies are designed to be flexible and adaptable and they’re big proponents of offering great customer service. Trust us, if you lose your ring and feel like you’re out thousands of dollars, having someone on the other end of the phone who truly cares goes a very, very long way.

They also offer convenient online tools for policy management and claims filing, so you don’t need to feel ‘in the dark’ about the specifics of your policy. No more information overload when it comes to insurance.

Selecting the Right Insurance

When you’re looking for the right insurance policy, it can feel like you can’t see the wood for the trees. The good news is, however, that many of those ‘trees’ represents great, reliable, transparent, and comprehensive insurance policy options, rather than would-be scams.

If you don’t know a lot about insurance, it can feel like everybody’s out to pull the wool over your eyes, but we’ve given you plenty of top-tier leads for your insurer search. Look for policies that are clear about what events are covered – and, of course, what events aren’t covered – and don’t just go for the cheapest option out there. Remember, this insurance policy is in place to serve you for decades to come. It’s not worth skimping on.

At the same time, don’t overspend. Get your ring appraised – maybe by a third party, if you want a little extra assurance – and make sure the opening for a policy would prove itself to be worthwhile in a pinch.

Our Expert Take

Engagement ring insurance is a very common very good idea. Just as an engagement ring is an investment into your future, you need to invest in your engagement ring feature. Diamonds are very strong, but, as we’ve mentioned, things can happen.

Whether it’s damage, theft, fire, loss, or anything else that stops You from being able to wear – or even look at – your engagement ring, don’t let it put you back to square one.

8 Frequently Asked Questions About Engagement Ring Insurance

- Q: What Does Engagement Ring Insurance Typically Cover?

- A: Engagement ring insurance usually covers theft, loss, and damage to the ring. However, coverage specifics can vary, so it’s important to read the policy details.

- Q: Is Engagement Ring Insurance Expensive?

- A: The cost can vary, but it generally ranges from 1-3% of the ring’s value per year. The exact cost depends on factors like the ring’s value, where you live, and the policy’s deductible.

- Q: How Do I Get Insurance for My Engagement Ring?

- A: You can obtain insurance either by adding it to an existing homeowner’s/renter’s policy or by purchasing a standalone policy from a specialized jewelry insurer.

- Q: Who Should Pay for Engagement Ring Insurance?

- A: Typically, the ring owner or the couple jointly pays for the insurance. It depends on personal preferences and financial arrangements.

- Q: Do Engagement Rings Need Regular Appraisals for Insurance?

- A: Yes, it’s recommended to have your ring appraised every few years to ensure your insurance coverage is in line with its current market value.

- Q: Can I Insure an Heirloom or Antique Engagement Ring?

- A: Yes, heirloom and antique rings can be insured. It’s often advised to get a specialized appraisal for such rings to accurately assess their value for insurance purposes.

- Q: Does Homeowner’s Insurance Automatically Cover Engagement Rings?

- A: Not necessarily. While some homeowner’s policies include limited jewelry coverage, it often falls short of the full value of an engagement ring. It’s advisable to check your policy or consider additional coverage.

- Q: How Much Should I Spend on Engagement Ring Insurance?

- A: The cost should be a percentage of the ring’s value, typically around 1-3% annually. Consider your ring’s value and your budget to decide the appropriate amount to spend.

- Q: What Happens If I Lose My Insured Engagement Ring?

- A: If you lose your insured ring, file a claim with your insurer. They will guide you through the process to receive a replacement or reimbursement based on your policy terms.

Embark on a secure journey of love with Jeweler AI. Click for bespoke guidance on engagement ring insurance and discover your ideal match in ring protection.

FOLLOW-UP GUIDE SERIES